EVERETT 提供全面的 PoS 金融服務,包括非託管質押、流動性質押衍生品 (LSD)、跨鏈解決方案和機構級託管服務。 我們的平台利用零知識證明和 BFT+POS 混合共識等先進技術,提供安全、高效且合規的金融基礎設施。

我們專注於機構採用和監管合規,以香港為基地,正在為下一代去中心化金融奠定基礎,並擴展至整個東南亞市場。

自研AI大模型,對協議進行分析、罰沒風險預測、流動性風險評估、多協議風險疊加分析、最優策略推薦

了解更多

我們的平台將尖端技術與監管合規相結合,為 PoS 生態系統提供機構級金融服務。

AI大模型+BFT+POS 混合共識與零知識證明驗證,確保跨鏈操作安全。

專業機構支持團隊,全天候提供全面的技術和監管協助。

多鏈支持,現階段重點拓展東南亞市場,通過香港-新加坡金融走廊。

香港運營基地,2025年申請第7類牌照。

代替了傳統工作量證明(PoW)中大量計算的依賴

質押降低了參與的門檻,讓更多用戶可以持有獲取收益

質押獎勵的多少取決於質押的加密貨幣數量和規則,收益多樣化

再質押是在多個鏈上進行質押,可以獲得更多的收益

越来越多的区块链项目开始采用权益证明(PoS)机制,并支持质押

越來越多交易所和平台都提供一鍵式質押服務,降低門檻增加用戶

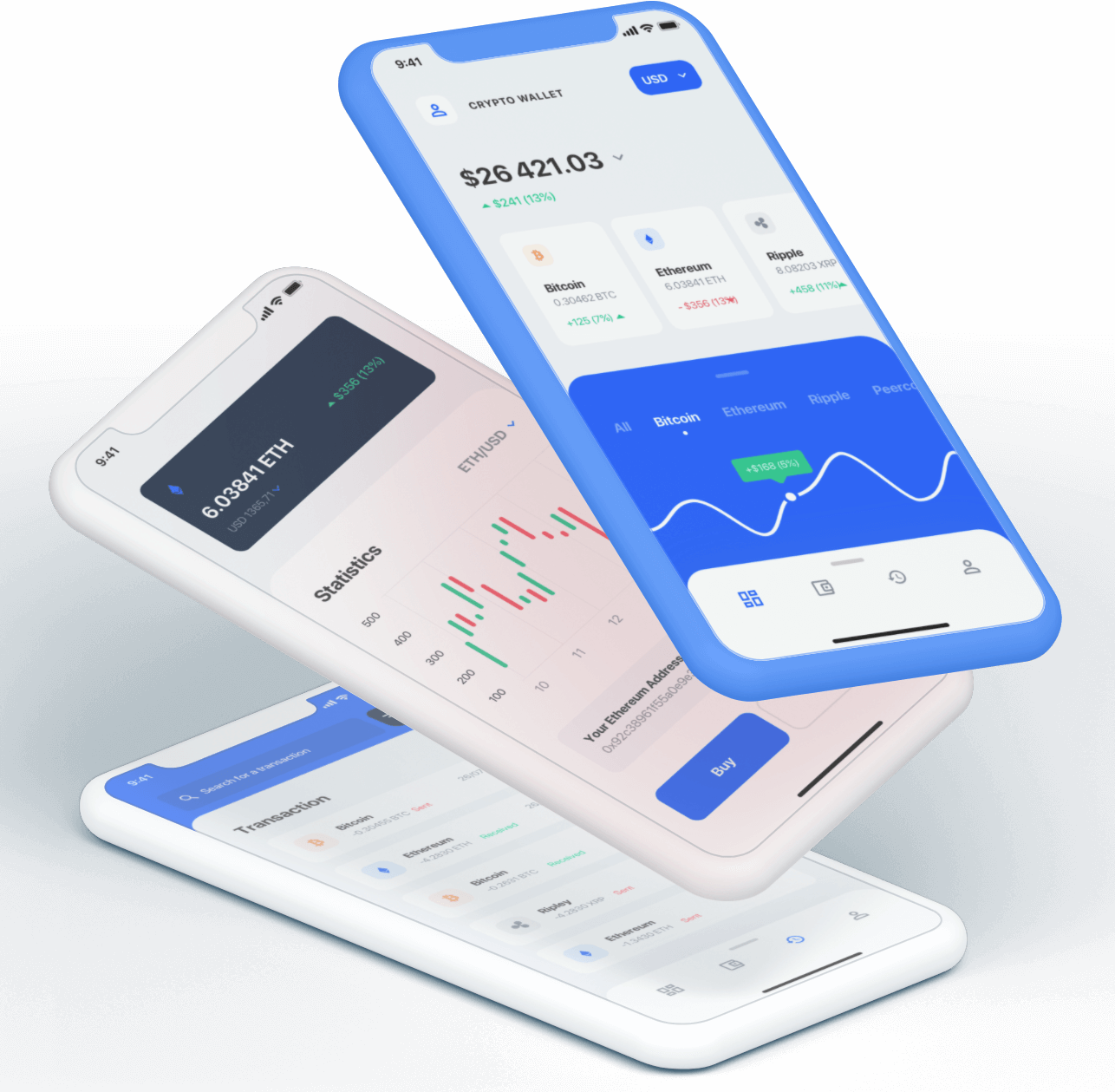

使用機構級質押服務、流動性質押衍生品、跨鏈解決方案和合規託管服務。我們的平台將先進技術與監管合規相結合, 為 PoS 生態系統提供安全高效的金融基礎設施。

質押(Staking)是權益證明(Proof of Stake, PoS)及其變種(如委託權益證明 DPoS)共識機制區塊鏈的核心功能。 質押允許特定代幣持有者,通過協助驗證交易區塊數據並提交至區塊鏈網絡來賺取獎勵。

質押有几大核心優勢:

質押(Staking)是 DeFi 市場中最大的領域之一,期中流動性質押協議 Lido 的質押總價值(TVL)居於榜首。

ReStake 是指涉及重複使用流動性質押代幣資產(例如 stETH)以質押到網路或其他區塊鏈平台的驗證器中的活動之一。

擁有的權益(代幣)越多,且願意鎖定參與的時間越長,則被選中來驗證交易和建立區塊的機會就越大。 這將網路安全與代幣持有者的經濟利益綁定在一起。

參與鎖定、驗證及質押、獲得獎勵、解除質押

我們的團隊隨時準備為您提供幫助。無論您有任何問題或需要支持,請隨時聯繫我們。